we have answers.

Do you work with a client who owns a small business currently struggling with financial difficulties?

Navigating the complexities of financial difficulties can be challenging and it’s often a complex decision-making process with various potential pathways, depending on the business’s financial situation. The key is being proactive and seeking advice early to maximise the options and tools available before the crisis becomes too severe.

Here is a refresher on “corporate financial distress stages” and when to seek turnaround advice: Corporate Financial Distress Stages

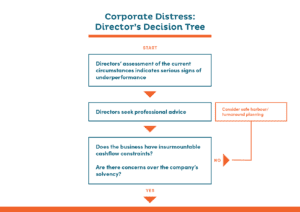

We have also put together a Corporate Distress decision tree to navigate the potential solution depending on the circumstances and extent of the financial distress.

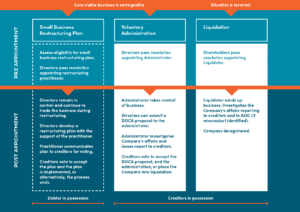

One of the new options (from 1 January 2021) is the Small Business Restructuring Plan (SBRP). The SBRP is a simplified, streamlined, expedited, and cost-effective procedure that allows financially distressed small businesses to reorganise their debts and operations, with the ultimate goal of restoring viability.

This process is managed by a Restructuring Practitioner experienced in assisting small businesses to overcome financial hurdles.

In 2023 there was a significant increase in the number of SBR’s from the previous year as more advisers and directors are becoming aware of the many benefits of SBRs and the success rates.

Small Business Restructuring Plan: Get Back on Track

What Does a Small Business Restructuring Plan Involve?

- Proposal Phase – Eligible small businesses have 20 business days to develop a restructuring plan.

- Acceptance Phase – An additional 15 days are allocated for creditors to cast their votes on the plan. To move forward, at least 50 percent (in value) of creditors must vote in favour of the plan.

The Restructuring Plan (Plan) is a means of paying a portion of the existing debt owed to creditors. Payments towards the Plan can be over a period of time, but no longer than 3 years.

Example:

- Mum and Dad Pty Ltd owes creditors a total of $500,000.

- Mum and Dad Pty Ltd cannot pay its creditors but it does have a viable business.

- Mum and Dad Pty Ltd appoints a Small Business Restructuring Practitioner and continues to trade.

- Mum and Dad Pty Ltd proposes a Restructuring Plan to its creditors.

The Plan’s details are:

- creditors will receive a total of 20% (being $100,000) of their total debts, and

- the amount will be payable every month over the following 3 years.

In this example ABC Pty Ltd will pay $2,777 each month towards the Plan over a three year period when the agreed $100,000 of debts will be fully repaid.

Mum and Dad Pty Ltd will also continue to trade. When the final payment is made, the terms of the Plan will be complete, and the Plan will end.

What Are the Benefits of a Small Business Restructuring Plan?

- Restructure debts: Reduce debtors to a management level to support a small business to survive.

- Control: The directors retain control over the operations of the business throughout the restructure.

- Expertise: A SBR practitioner assists the Director prepare a restructuring plan and navigate the process.

- Cost Efficiency: The process is designed to minimize costs for small businesses. A SBR practitioner charges a fixed cost.

- Simple: SBR Plans are designed to be streamlined progress compared to Voluntary Administration.

- Protection: A successful SBR can assist with protecting personal liability related to insolvent trading and may prevent the ATO issuing Standard Director Penalty notices.

- Breathing Space: Creditor Moratorium where unsecured creditors cannot begin, continue, or enforce their claims.

In part two of our series, we’ll dive deeper into the process and eligibility criteria to help you determine if your client could benefit from this restructuring solution.

If you have clients who could benefit from the SBR process, talk to us today to arrange a confidential consultation.