we have answers.

In a previous article we talked about how a corporate turnaround works, and how it’s crucial to take action early and seek appropriate advice before the situation is taken out of your control.

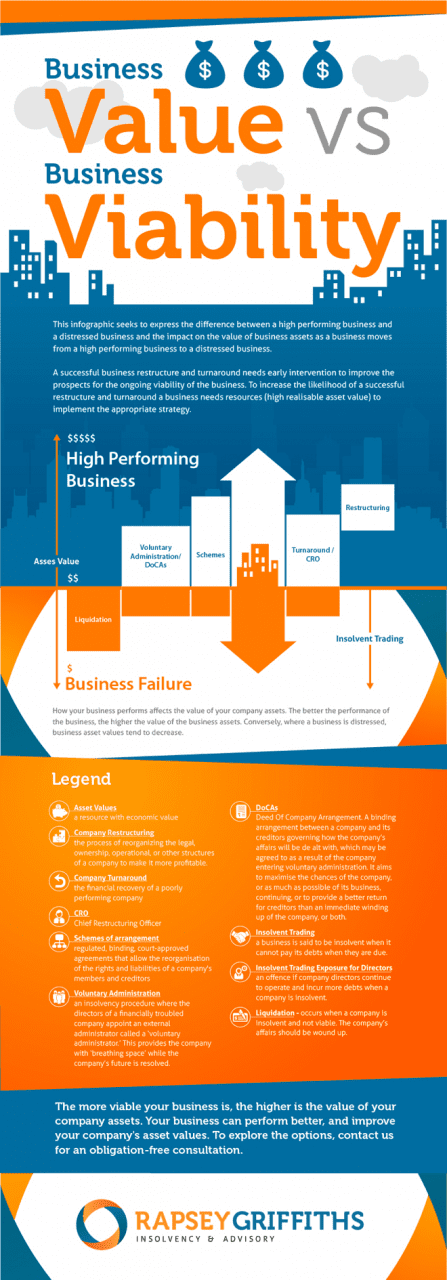

As you can imagine, there’s significant financial cost involved in completing a corporate turnaround or restructure. So the business needs either adequate internal resources or external funding to ensure it’s guided through its troubles to become a much stronger company.

And that’s why taking action early is so important, when your business and its assets still have significant value.

This infographic shows the difference between a high-performing business and a distressed business, and how the value of assets changes as the business moves from one to the other.

Click to view the full infographic

What’s driving these business failures we’re dealing with? They didn’t take strategic action quickly when they:

- found themselves in a tight financial position

- could foresee the sector weakening.

In these situations, it’s vital to take appropriate steps and implement a turnaround strategy quickly to avoid a formal insolvency appointment and give the business the best chance to survive.

The team at Rapsey Griffiths has a wealth of experience in corporate turnarounds and restructures. So if you’d like to talk to someone about your client’s situation, feel free to get in touch with us.