we have answers.

In the first part of our Small Business Restructuring (SBR) series, we introduced the concept of the Small Business Restructuring Plan (SBRP) and highlighted its benefits for struggling small businesses. Now, in part two, we dive deeper into the process and eligibility criteria to help you determine if your client could benefit from this restructuring solution.

Eligibility Criteria:

As of January 1, 2021, small businesses facing financial difficulties have access to the Small Business Restructuring Plan, which offers a lifeline for those in need. At Rapsey Griffiths, we specialise in small business turnaround and restructuring, and we can guide your clients through this process.

Eligibility Requirements:

To be eligible, the company must:

- have debts owing of less than $1 million

- and its associated director/s have not utilised a Small Business Restructure or undertaken a Simplified Liquidation in the prior 7 years

- all taxation lodgements need to be up to date, and

- all employee entitlements that are due and payable have been paid.

The Process:

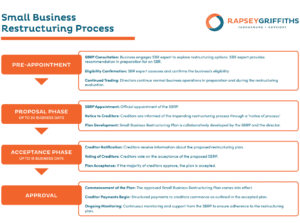

Appointment of a Practitioner: The directors of the company appoint a small business restructuring practitioner. This practitioner plays an important role in overseeing the entire process, ensuring its integrity and fairness.

Notice to Creditors: A notice of process commencement is provided to creditors. This notice outlines how creditors can access relevant information about the process, maintaining transparency and accessibility.

Plan Development: The directors of the company, with the guidance of the practitioner, develop a restructuring plan. The practitioner then assesses the company’s financial affairs and certifies the plan based on this assessment.

Presentation to Creditors: The restructuring plan, accompanying information, and the practitioner’s certification are made available to creditors. This transparency is key in gaining the trust and support of creditors.

Creditor Voting: Creditors vote on the plan and verify the amount of their debt. Approval of the plan requires a majority of unrelated creditors by value who respond by the deadline.

Plan Commencement: If the majority of creditors by value vote in favour of the restructuring plan, the plan commences, and the practitioner is appointed to oversee the plan, ensuring that it is executed effectively.

Plan Rejection: If a majority of creditors by value vote against the restructuring plan, the process comes to an end. The directors may then explore other insolvency options to address the financial difficulties.

Preparation Checklist for a Formal Debt Restructuring Process: When considering the Small Business Restructuring Plan, your client must be well-prepared. Here’s a checklist to help guide them through the initial steps: SBR Checklist

In part three of our series, the focus shifts to the role of the Small Business Restructuring Practitioner (SBRP) in guiding clients through financial distress.

If you have clients who could benefit from the SBR process, talk to us today to arrange a confidential consultation.