Information and advice

Tools and resources

we have answers.

Beyond standard wind up actions for companies and bankruptcy proceedings for individuals, the ATO’s powers extend to director penalty notices, garnishee orders to third parties, estimates and default assessments.

Non-compliance with the ATO’s requirements can have serious repercussions. Therefore, it pays to be informed, upfront, lodge company statements on time and maintain your books.

The ATO’s approach

The ATO takes an open and transparent approach to debt recovery based on 4 stages: Prevention, Early Intervention, Firmer Action and Stronger Action. Most taxpayers pay amounts they owe on time or shortly after the due date. If you do not take steps to resolve your ATO debt a tough stance is taken on non-complying businesses regarding unpaid tax liabilities, particularly those companies that:

- Repeatedly default on payment arrangements

- Avoid financial obligations by liquidating companies and setting up new business entities (phoenix activity)

- Are experiencing escalating debt with no signs of the ability to meet their obligations

- Avoid contact with the ATO

It’s vital that directors and companies keep payments and contributions up to date and communicate with the ATO about their position.

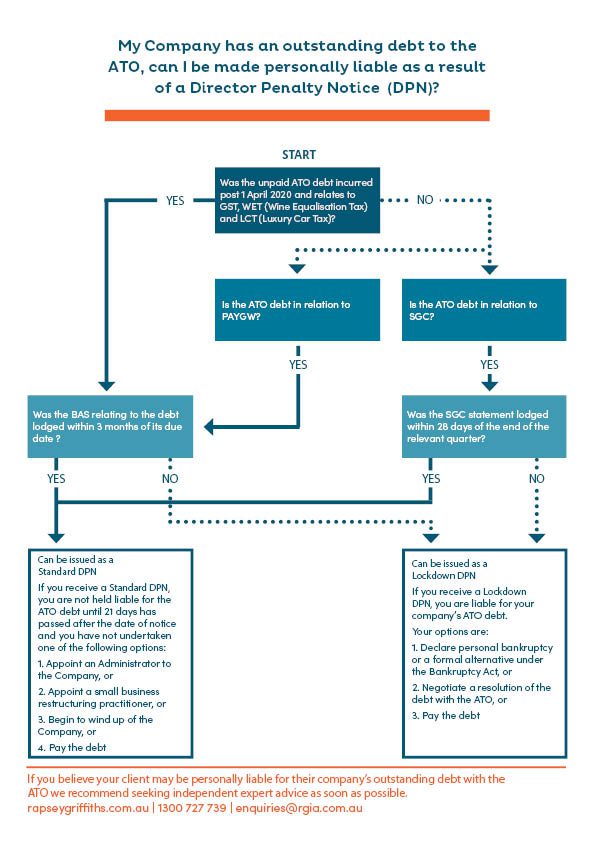

One of the most powerful tools at the ATO disposal is the ability to issue a ‘director penalty notice’ (DPN) against company directors for certain company debts. These debts include pay as you go (withholding) (PAYGW), the superannuation guarantee charge (SGC), goods and services tax (GST), wine equalisation tax (WET) and luxury car tax (LCT).

The director penalty regime is contained within Division 269 in Schedule 1 to the Taxation Administration Act 1953 (TAA). Under the regime, the ATO now distinguishes between two types of DPN: Standard DPN and lockdown DPN and has the power to issue a garnishee notice to a third party (e.g., a bank) who owes the company/director money.

Standard or ‘non-lockdown’ DPN

The ATO issues standard or non-lockdown DPNs when a company has lodged its business activity statements (BAS) or instalment activity statements (IAS) on time, but debts remain unpaid.

This written notice identifies the unpaid amount of the company’s unpaid PAYGW, GST, WET, LCT or SCG liabilities (in the case of SGC, the amount includes a nominal interest component and administration fees) and states that the director is liable to pay the ATO that amount as a penalty.

The ATO can issue a DPN against a director who has resigned or who has come on board since the liabilities were incurred, provided they’ve been in office for more than 30 days (including shadow and de facto directors).

This means a newly appointed director can be liable to pay outstanding liabilities if the director has been in office for more than 30 days.

A DPN is sent to the last known ASIC company address, so the onus is on directors to keep their registered ASIC details and company records up to date. Once a DPN is issued, the director has 21 days (from the date the notice was posted, not received) to do one of the following:

- Pay the outstanding debt, or

- Appoint a small business restructuring practitioner, or

- Appoint a voluntary administrator, or

- Enter the company into liquidation.

Under the DPN, each and every director owes the same amount as the company’s total liability for tax. For example, if a company’s unpaid debt is $15,000, each director’s DPN will be issued for the amount of $15,000.

Lockdown DPN

With a lockdown DPN (also referred to as the ‘three-month lockdown’ provision), if a company fails to lodge its activity statements in respect of PAYGW, GST, WET, LCT within 3 months of their due dates, or SGC returns to the ATO within 28 days of the end of the relevant quarter, the directors become automatically liable. They can’t appoint a voluntary administrator or liquidator to avoid personal liability for payment.

A DPN is sent to the last known ASIC company address, so the onus is on directors to keep their registered ASIC details and company records up to date. Once a DPN is issued the directors have to either:

- pay the debt in full

- enter into personal insolvency

- rely on one of the defence provisions (s 269-35, Schedule 1 TAA).

A lockdown DPN can be issued at any time, regardless of whether the director has already placed the company into liquidation or voluntary administration.

Garnishee notices

Under s 260-5 TAA, the ATO has the power to issue a garnishee notice to a third party (e.g., a bank) who owes the company/director money, demanding the party pay straight to the ATO. Any money garnisheed by the ATO cannot be recovered in a liquidation as an unfair preference.

A garnishee notice can ask for a percentage of wages or may seek payment of a lump sum amount. For individuals, that may mean the ATO issues a garnishee notice to your client’s employer or contractor. For businesses, the notice may be issued to your client’s financial institution or trade debtor.

Non-lodgment: estimates & default assessments

If a company is not forthcoming about its unpaid liabilities, the ATO can step in and estimate an outstanding PAYG, GST, WET, LCT or SCG liability on behalf of the company giving notice to the company of their reasonable estimate (Subdivision 268B Schedule 1 TAA).

The estimate then becomes payable in its own right as a separate and parallel liability with the actual shortfall (s 268-20). However, there is an opportunity to provide a statutory declaration specifying the actual amount of the liability.

Failure to pay the estimated sum results in the director being liable for a penalty. It can then form the basis of a statutory demand to wind up the company under s 459 Corporations Act 2001 (Cth). The ATO also has the power to issue a default assessment (s 167 Income Tax Assessment Act 1936 (Cth)).

What should directors do?

To avoid the long arm of the ATO directors should:

- Ensure ASIC details and records are up-to-date

- Report on time (BAS and superannuation guarantee charge statements)

- Be proactive and timely in obtaining advice

- Remain informed about PAYG and SGC payment obligations

We offer a range of business & corporate services.

Find out more